LVMH, the world’s largest luxury conglomerate, witnessed a surge in sales towards the end of last year, driven by affluent shoppers indulging in the group’s high-end handbags and Champagne. This impressive performance is indicative of the conglomerate’s resilience in the face of economic challenges.

The company’s shares experienced their most significant increase in 15 years, contributing approximately €43 billion ($46.8 billion) to LVMH’s market value. In the fourth quarter of the previous year, revenue saw a remarkable 10% organic growth, surpassing expectations and providing reassurance to both analysts and investors. LVMH, headquartered in Paris and boasting 75 brands, including iconic names like Louis Vuitton and Christian Dior, holds a pivotal position as a bellwether for the luxury industry.

Also Read : Tragic Death of British Ballet Dancer Orla Baxendale in the US Due to Undeclared Allergens in Cookie

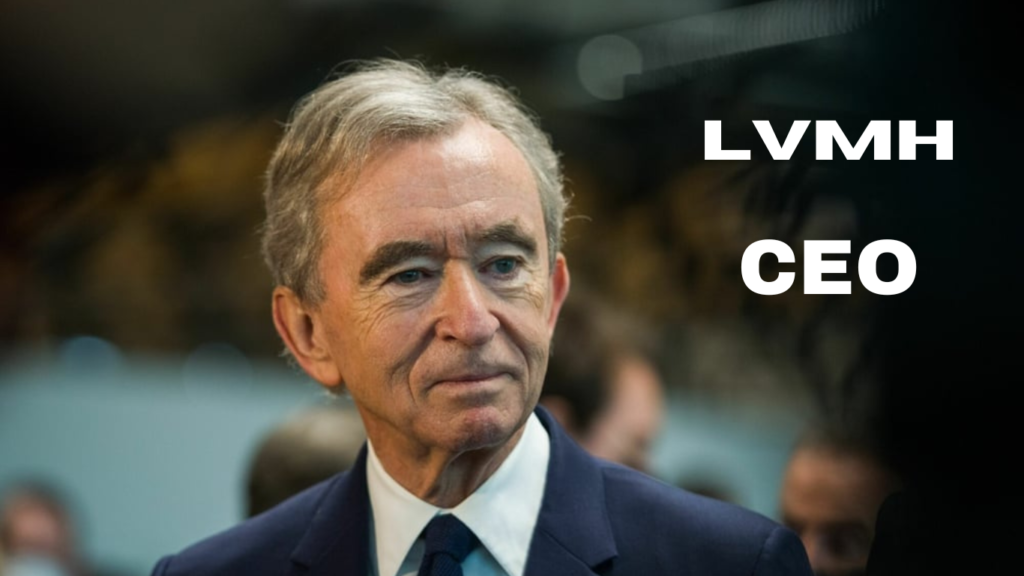

Billionaire Bernard Arnault, the CEO of LVMH, expressed high confidence in the outlook for the current year. The positive sentiment from the management aligns with the belief of Citigroup analyst Thomas Chauvet, who stated that the upbeat tone supports the notion that 2024 could be a year of smooth normalization for LVMH.

While the post-pandemic boom that propelled LVMH Moët Hennessy Louis Vuitton SE to become Europe’s most valuable company slowed in the latter half of the previous year due to inflation, the latest results from LVMH and Richemont, the owner of Cartier, suggest that the strongest brands weathered the crucial holiday shopping season successfully.

Also Read : Air India Express : FAA Halts Boeing 737 Max Expansion, Spells DELAY DOOM for Indian Airlines’ Mega Orders!

LVMH shares soared by as much as 13%, leading a broader rally for luxury peers, including Kering SA, the owner of Gucci, and Moncler SpA. This robust performance reinforces LVMH’s position as a powerhouse in the luxury sector.