On January 20, railway stocks experienced a surge of up to 13%, marking a continued record-breaking trend in anticipation of the Interim Budget scheduled for February 1. With strong indications of Narendra Modi’s potential return to power post-general elections, analysts predict a sustained emphasis on infrastructure-driven growth and the ‘Make in India’ initiative. The market closely observes the expected high allocation towards railways, considering it a significant aspect of government policies.

Despite being a pre-election interim budget, the upcoming financial plan is eagerly anticipated as if it were the final budget due to expectations of the ruling government’s return to power. The Government of India has consistently prioritized infrastructure development, encompassing both digital and physical aspects. Mukesh Kochar, the national head of wealth at AUM Capital, emphasized the expectation for continued focus on various assets such as roads, airports, ports, and railways.

Also Read : Union Bank of India Posts Robust Third Quarter Performance with a 60% Surge in Net Profit

Notably, stocks of Ircon International reached a fresh all-time high of Rs 261.50 on the NSE during morning trading, registering a 13% surge. The stock has exhibited positive momentum in nine out of the last ten trading sessions, achieving nearly a 50% increase in the current month and an impressive 300% gain over the past year, outperforming the Nifty 50 benchmark.

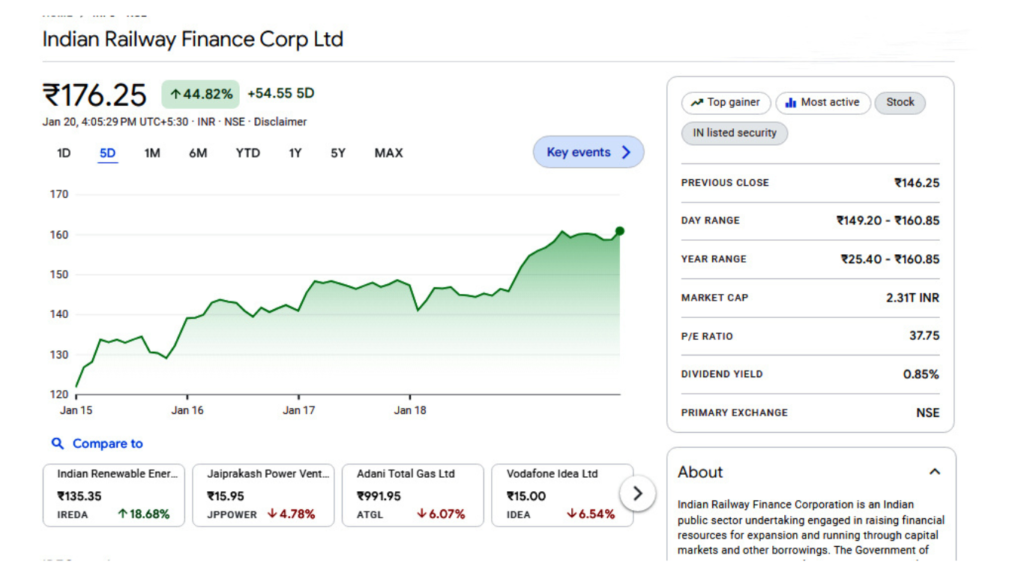

Simultaneously, IRFC shares reached an all-time high of Rs 176.25, experiencing a 1% surge on January 20, boosting its market capitalization to over Rs 2.3 lakh crore. This surpassed the market capitalization of Power Grid and 21 other Nifty companies. IRFC has demonstrated exceptional performance, doubling investors’ money in three months with a remarkable 128% rally during this period and a staggering 400% surge over the last year. Caution is advised due to the low float of IRFC, with the government holding over 86% stake, making the stock susceptible to extreme price reactions.

Also Read : HPSC Assistant Professor Recruitment 2024 : Announces Recruitment of 3800 Assistant Professors